Islamic Banking

1. Introduction

Islamic banking is also known as non intrest banking. It is based on the principles of Islamic Law or Sharia. In Islam money has no intrinsic value. Hence it can not be sold at a profit.

2. What The Islamic Law Says

The Islamic Law or Shariat prohibit the collection and payment of Intrest or RIBA (as called in Arabic) by lenders and investors. Infact Riba is forbidden under Sharia law (Islamic religious law) because it is thought to be exploitative. It also prohibits any sort of investment in businesses that are considered Haram or against the principles of Islam. It is largely believed that these principles have been derived from the Quran.

3. Modern Islamic Banking

The first successful example of an Islamic Bank was seen in Malaysia. In 30 September 1963, Tabung Haji came into being with a total of 1,281 depositors which increased to 8,67,220 depositors with deposits over one billion Malaysian Dollars.

It came into being due to high demand of interest free money for pilgrimage (Hajj).

The success of Tabung Haji led to the formation of the Naseer Social Bank in Cairo, Egypt in the year 1972. Later, the Islamic Development Bank with a view to promote economic development of the Muslim community in accordance with the Sharia Law.

4. Islamic Development Bank Group

It was founded in 1973 by the Finance Ministers at the first Organisation of the Islamic Conference (now called the Organisation of Islamic Cooperation) with the support of the King of Saudi Arabia at the time (Faisal), and began its activities on 3 April 1975.

On the 22 May 2013, IDB tripled its authorized capital to $150 billion to better serve Muslims in member and non-member countries. The Bank has received credit ratings of AAA from Standard & Poor's, Moody's, and Fitch. Saudi Arabia holds about one quarter of the bank's paid up capital. The IDB is an observer at the United Nations General Assembly.

5. How Islamic Banks Function

In Islam the investor should not make an undue profit from the hard work of the others. But it is permitted to follow a system of reasonable profit and return from investment where the investor takes a risk. Thus Islamic Banks make available accounts which provide profit or loss instead of interest rates.

6. Where Is Money Invested

The banks use money collected by them and invest in something that is Shariat compliant or is not Haram and does not involve high risks.

Thus, businesses involving alcohol, drugs, war weapons, etc. as well as all other high risk activities are prohibited.

Islamic Banking, therefore, acts as an agent by collecting the money on behalf of its customers, investing them in Shariat Compliant projects and sharing the profit or losses with them.

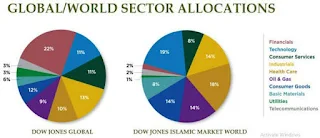

7. The Dow Jones Islamic Market Index (DJIM)

The Dow Jones Islamic Market Index (DJIM), launched in 1999 in Bahrain, was the first index created for investors seeking investments in compliance with Muslim Sharia law.

The DJIM has an independent Shari’ah (Islamic Law) Supervisory Board. The DJIM screens have been adopted by the Accounting and Auditing Organization for Islamic Financial Institutions ("AAOIFI")-Standard 21.

The DJIM measure the performance of a global universe of investable equities that have been screened for Shari’ah compliance consistent with Dow Jones Indexes’ methodology. The selection universe for the DJIM family of indexes is the same as the universe for the Dow Jones World Index, a broad-market index that seeks to provide approximately 95% market coverage of 44 countries.

8. Spread of Islamic Banking

There are plenty of non-Islamic countries that are now opening Islamic "windows" in conventional banks, like China, Germany etc.

U.K. was the first non-Islamic country to permit a complete Shariat Compliant bank called the Islamic Bank of Britain

U.K. also issued Islamic Bonds known as SURUK in 2014.

United States of America has the American Finance House LARIBA.

Global Share of Islamic Finance Banking Assets, 2015.

9. Islamic Banking in India

Introduction of Islamic Banking was mooted by Raghuram Rajan in his report on the Financial Sector in the year 2008. He recommended that interest free banking techniques should be operated on a larger scale so as to give access to those who are unable to access banking services. However, the Indian banking laws will have to be amended to incorporate Islamic banking e.g. Banking Regulation Act 1949.

This will encourage many from the Muslim community to come forward and invest in projects which they may not be willing to put in the conventional banks.

India will be able to attract huge investments from West Asia. This could result in attracting huge funds in the domestic share market.

If you have any doubt, suggestion or question, feel free to contact us.